Three Key Properties of Assets

- Ownership: First, a company must have ownership or control of the asset. This enables the company to convert the asset into cash or a cash equivalent and limits others’ control over the item. Note, right of use assets aren’t always convertible. Lease agreements often stipulate that the lease cannot be transferred or sold. The ownership property is important when considering an asset’s informal meaning versus its technical meaning. For example, companies often say their employees are their “greatest asset,” but in terms of accounting, companies don’t have true control over them—employees can easily leave for a new job.

- Economic value: Second, an asset must also provide economic value. All assets can be sold or otherwise converted to cash, except for some right of use assets such as lease agreements. In that way, assets can be used to support production and business growth.

- Resource: Finally, an asset must be a resource, which means it has or can be used to generate future economic value. This generally means that the asset can create future positive cash inflows.

Importance of Asset Classification

Properly classifying assets is important for company leaders to have an accurate picture of key financial metrics such as working capital and cash flow. Asset classification can also help a business qualify for loans—it gives the bank a clearer picture of the risk it’s taking on—work through bankruptcy and calculate tax liabilities.

Distinguishing operating assets from non-operating assets also helps organizations see how each asset type drives overall revenue.

Three Classifications of Assets

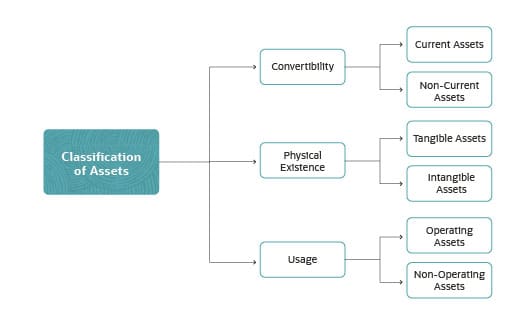

Business assets can be divided into three different categories based on their convertibility, physical existence and usage. What are these three types of assets?

- Convertibility describes how easily assets can be converted to cash.

- Physical existence describes whether an asset physically exists or is intangible.

- Usage describes the purpose of an object as it relates to business operations.

How Do Assets Play Into Accounting?

Understanding and properly valuing assets is integral to accurate accounting, business planning and financial reporting. And in the case of public companies, accurately accounting for leased assets is required by law. Classifying and valuing assets is critical to understanding a company’s cash flow and working capital. Accountants have to properly classify assets for purposes such as securing credit and obtaining insurance. They also have to properly value assets in order to calculate depreciation and amortization for tax purposes, and to enable the company to sell them if necessary.

Automated Asset Management Solutions

Keeping track of assets can be challenging given the number and diversity of assets a company may own. Automated asset management solutions offer a way to inventory, categorize and track assets in order to understand their value and plan operations efficiently. Asset management solutions can also help to track and plan the operational life cycle of an asset from acquisition to disposal, including operating and maintaining the asset. In addition, automated asset management solutions can help a company comply with shifting government or industry regulations.

Assets include almost everything owned and controlled by a company that’s of monetary value and will provide future benefit. Assets are classified by how quickly they can be converted to cash, whether they are tangible or intangible, and how a business uses them. Assets are a key component of a company’s net worth and an important factor in its overall financial health.